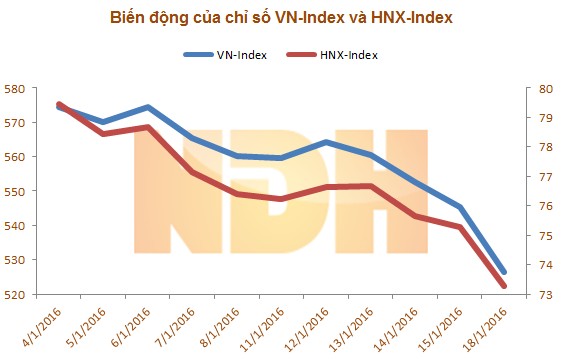

The panic trading of Viet Nam market stock on 18 Jan 2016 at times pushed the VN-Index dropped 24.8 points. VN –Index ended down by 3.07% to 526,37 points. The 510 point -530 point lavel is that the solid support of VN – Index over the past 2 year. This is a support area is considered attractive areas of VN-Index. The main cause of the slumping of VN-Index is often as the internal problems of Vietnam, or by the impacs of external factors to Vietnam. This slumping, VN Index slide as panic of the world stock market ( especially China’s market), as Foreign investors have been net sellers, the oil prices fell below $ 30 a barrel, the prices of commondities sharply, uncertainty of monetary policy (ex: to discount CNY). In additional, the Communist Party of Vietnam is preparing major changes in personnel is one of the factors affect to VN Index in this times. Is there A recession worse than 2008 is coming?

From the beginning of the year to end the trading session 01.18.2016, within 11 trading days of the total capitalization on HOSE and HNX lost to 113.3 trillion (US $ 5 billion). VN-Index lost 52 points equivalent to 9.1%.

On 19 Jan 2016, VN Index has rebounded, up to 9.4 points, or 1.79%, the index closed at its highest level during the day 535.77 points. However, view of RiskInfo.vn at this time then we only observed although the market will have good news as the fourth quarter results to be announced, the TPP will be signed on 04.02.2016,v.v.