Kim Long Securities Corporation (KLS) is a joint stock company established in 2006, is one of the first securities company in Vietnam. KLS was founded and run by experienced professionals and worked for the State Securities Commission of Viet Nam (SSC). In AGM’2016, KLS will KLS will officially announce its plan to dissolve and delist from the local market.

From a small company charter capital of VND 18 billion, KLS has quickly rose to become one of the two securities firms have the largest scale capital market with charter capital reached VND 2,025 billion. The shareholders of KLS are very lucky when Leaders of company still retain capital. With big cash of KLS is dream of all Securities Corporations, but BOM of KLS can not make decisions to invest in Viet Nam’s stock market. Is this a sign of professional investors were discouraged Vietnam’s stock market?

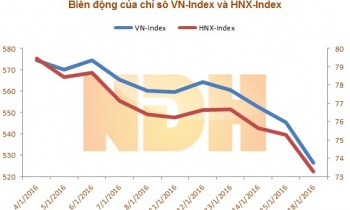

KLS Chairman Hà Hoài Nam said: For the past several months, KLS shares traded around VND6,000 to VND7,000 each, much lower than the book value of VND12,489. In addition, with the liquidation of all assets and portfolios, and more than 182 million KLS shares, shareholders were expected to have VNĐ11,000 per share. It can be said that the saddest point of Vietnam’s stock market in general, the agency’s managing Vietnam’s stock market in particular. Just look HNX impossible to get 100 points milestone within the past few years, this is enough to say the weakness of the Viet Nam’s stock market.

By far, KLS is known for saving money in Bank in stead of investment. Does Vietnam’s stock market were too small, but big potential risk, organizations have a large amount of money does not dare to invest. We realize that, not only KLS which many major securities, The profits of proprietary trading of securities firms are verry small. This mean is securities companies have focused on investments in stocks. Currently, the profits of many securities companies operate mainly through margin, repo, brokerage fees, etc.

So Vietnam’s stock market is in the hands of whom? Who will be the market makers?